TAMPA, Fla. — Florida is rolling out a tax break that will save homeowners money while getting their homes ready to withstand hurricane season.

The Home Hardening Tax Exemption, which was recently signed into law by Gov. Ron DeSantis, is a two-year, $462 million sales tax exemption on impact-resistant doors, garage doors and windows.

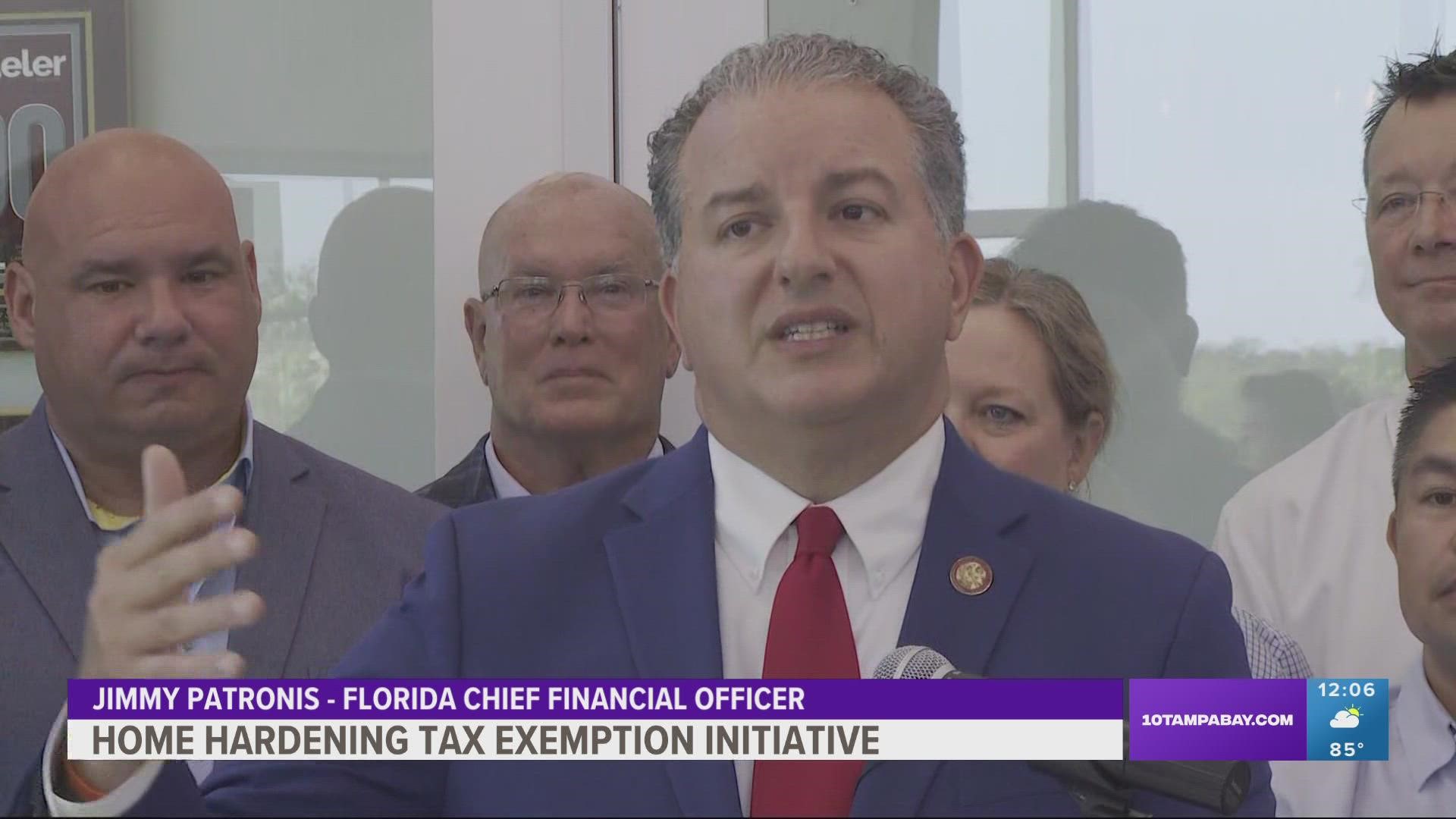

Chief Financial Officer (CFO) Jimmy Patronis came to Tampa on Tuesday to give more details about the initiative.

The CFO explained that giving Floridians the opportunity to fortify their homes against storms will result in lowered insurance premiums.

“The single biggest investment any Florida family will ever make is their personal residence," he said.

Here's how it works.

Floridians can purchase and install eligible mitigation improvements on their homes during the tax-free period. Then, they can contact a qualified inspector to properly document the home's new features. The completed wind mitigation inspection form can be submitted to the insurance company to apply for premium savings discounts.

As Patronis explained, Florida law requires insurance companies to extend premium discounts for projects associated with the Home Hardening measure.

The temporary sales tax exemption period begins July 1, 2022, and ends June 30, 2024.

While Florida is working to better protect homes against hurricanes, federal officials are also launching an initiative to make buildings more resilient to disasters.

It involves modernizing building codes to help communities better withstand hurricanes, flooding, wildfires, and other extreme weather events that are intensifying due to climate change.