JACKSONVILLE, Fla — Are you buying your first home? You’re not alone.

The National Association of Realtors says first time home buying is on the rise over the last 2 years. If you want to become one yourself, we've put together a step by step guide with help from local experts: a homeowner, a realtor, and a mortgage lender.

Ingrid Garcia Polanco has been in her new condo for about a month. She says it is worth it.

She’s already making it feel like hers with details of her Columbian roots decorated throughout. This is her second time buying a place, but over the past year she was a renter.

“It’s too expensive," she said about renting. "I’d rather pay my own house than pay somebody else house.”

“We always like to say you can’t build wealth in a home you don’t own," said CC Underwood.

Her Sellin’ Like CC team sell hundreds of homes every year in and around Jacksonville. She says affordability is still a major issue in the local housing market, but prices are beginning to stabilize.

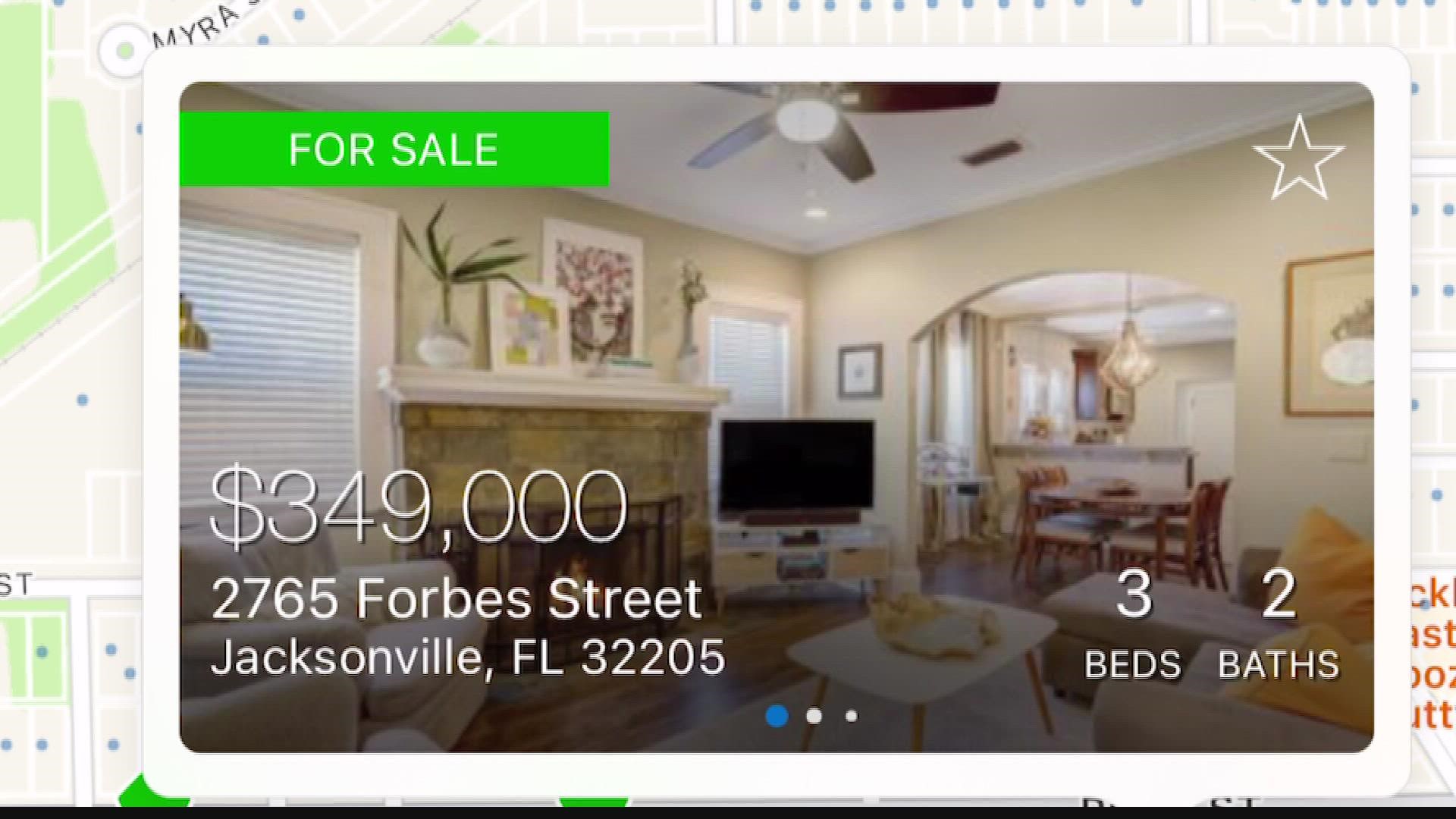

“You don’t want to wait," Underwood said. "Now is an opportunity. If you are in the 400, 500, or even 350,000 price point, if you see an opportunity jump on it.”

A third of all home buyers last year were buying for the first time, according to NAR. We've broken down the process into 8 major steps, with some important details and nuances in between.

1. Figure out your finances and your credit score.

What can you afford? Here’s some advice from Shauna Thompson, a Jax Federal Credit Union mortgage loan originator, on how to figure out what you can afford monthly on a home.

“If you’re renting now, just take in consideration your rent plus your property tax, homeowner’s insurance, and if you have private mortgage insurance which can be a monthly expense as well," Thompson explained. "So If you are comfortable with your rent, think another 2 or 300 dollars can be added to that. That can kind of sway you up or down if you think you can afford a little bit more or if you want to go a little bit less than that.”

“Budget and savings," reiterated Polanco.

In order to buy a home, you’ll need cash for the down payment, closing costs and any inspections. We’re talking 15,000 and up. Here's a quick breakdown of what you might expect to pay for in cash.

- Down payment in cash (3% and up)

- Closing costs (3-3.5% of purchase price)

- Inspections ($1k for home inspection on average)

Check out online calculators like this one with USAA or this one with Nerd Wallet.

2. Find a mortgage broker or lender.

They can tell you what you can afford and give you a pre-approval for a mortgage, which you'll need before you go look at homes.

“Ideally you want to come to me before you start looking," said Thompson.

"Say hey I want to look for a home.”

Thompson can tell you how much money you’ll need in cash and how much money you could get for your loan.

Underwood advises choosing a local lender, someone you can reach at all hours of the house buying process.

Thompson says you should bring these documents when you come for an appointment with a lender: ID, SSN, last two years of tax returns, two months of bank statements, and last two W2s.

3. Get a realtor

Find someone you trust and then have a buyer consult with your realtor so they know exactly what you’re looking for and your budget.

Then start looking, both online and in person.

Underwood says pre-approvals are usually only good for 90 days so keep that in mind when you are looking.

4. Find some free money.

"It was pretty easy and it was less than I was expecting," said Polanco.

She's a second time homebuyer, but you can also have a similar experience as a first timer.

“Many states offer homebuyer programs," said Thompson. "They help with down payment and closing costs. There is a partnership with through the Federal Home Loan Bank of Atlanta. For first time eligible homebuyers, they can quality for up to $7,500 in funds to help with closing costs, down payments, counseling and renovations. Things like that.”

That's just one program Jax Federal Credit Union offers. Thompson says they have a program on top of that where you can apply for another $5,000 in help with your down payment.

So check with your lender as well as your local government. Ask what can they do for you!

Jacksonville as well as other city and counties also have first time homebuyer programs to help you out. Apply! Don’t leave the free money behind.

Find more information on Jacksonville's first time homebuyer program here.

Check out the down payment assistance programs that runs statewide with the Florida Housing Finance Corporation.

5. Found a home? Time for an inspection!

This will cost you cash out of pocket. If you find something, offer under the asking price or put in stipulations to have certain things fixed before move in.

Your realtor should help advocate for these fixes.

6. Make an offer!

Underwood says buyers have power as the market corrects.

“It’s a great opportunity for buyers to go in under the asking price. It’s also a great opportunity to ask the seller to pay for closing costs," Underwood explains. "A lot of that money can go towards a rate buy down which I know is going to be very important to a lot of buyers right now.”

7. Choose a mortgage

- Conventional Mortgage Loan: Thompson says this is the one they use most often with first time homebuyers at Jax Federal. More information on this type can be found here.

- FHA Loans: This type requires lower credit scores and smaller down payments. It aims at helping people who usually wouldn't be able to buy a home, but you will have to pay FHA mortgage insurance on top of mortgage insurance that you normally pay if you put less than 20% down. More information on that type here.

- USDA Loan: If you are purchasing a home in a rural area, then this might be the loan for you. Find more information here.

- VA Loans: Veterans and active military buying a home can qualify for this type of loan. Find out more on this type of loan here.

8. Buy your first home!

You did it. Congratulations!