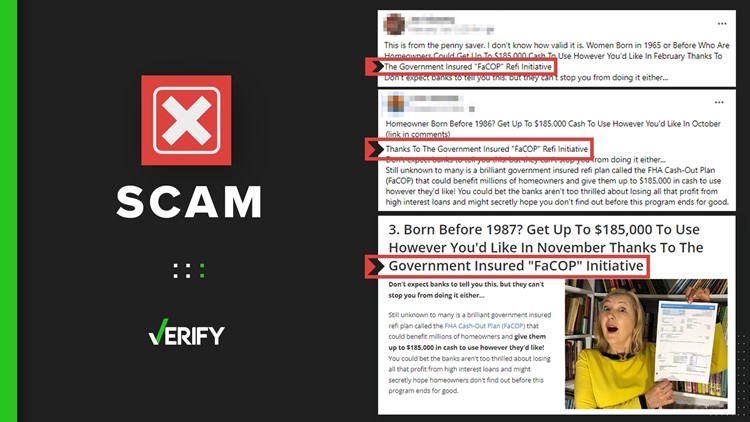

Multiple online ads and social posts that have been circulating since late 2022 claim homeowners can get up to $185,000 in cash through a government-insured program called the “FaCOP Refi Initiative.”

“FaCOP refi” is a term many mortgage lenders and the government use to refer to a federal assistance cash-out program called FHA cash-out refinance, according to The Mortgage Reports, a mortgage financing advice website. An FHA cash-out refinance allows eligible homeowners to refinance their existing mortgage for a larger loan than they currently have and receive the difference as a lump sum of cash.

Several VERIFY readers, including Karen, asked if “FaCOP Refi Initiative” ads that promise up to $185,000 in cash from the federal government are legitimate.

THE QUESTION

Are “FaCOP Refi Initiative” ads that promise up to $185K in cash from the federal government legitimate?

THE SOURCES

- U.S. Department of Housing and Urban Development (HUD)

- Federal Housing Administration (FHA)

- Federal Trade Commission (FTC)

- USA.gov, the official web portal of the federal government

- Better Business Bureau (BBB)

- Bankrate

- Credit Karma

- LendingTree

- The Mortgage Reports

THE ANSWER

No, “FaCOP Refi Initiative” ads that promise up to $185K in cash from the federal government are not legitimate.

WHAT WE FOUND

The “FaCOP Refi Initiative” is not a legitimate cash-out refinance plan backed and insured by the Federal Housing Administration (FHA), according to the U.S. Department of Housing and Urban Development (HUD). “FaCOP Refi Initiative” ads that claim the government is giving up to $185,000 in cash to homeowners are scams created to steal personal information.

“One thing to note on the ‘FaCOP refi’ is to be cautious of recent online scams offering free money to applicants,” says The Mortgage Reports, a mortgage financing advice website. “Keep in mind that only FHA cash-out refinances backed by and insured by the FHA are legitimate.”

A legitimate FHA cash-out refinance plan allows homeowners to access the cash value of the equity in their home by refinancing their current mortgage with a larger one and then receiving the excess in cash. But to qualify, homeowners must meet certain standards set by the FHA and can only apply with an FHA-approved lender. This means they can’t just sign up to get the payout through an online ad that’s not affiliated with the agency.

How much you can borrow with an FHA cash-out plan depends on the amount of equity you have in your house, according to The Mortgage Reports. As a general rule, homeowners can borrow up to 80% of their home’s appraised value, minus any existing mortgage balance.

For example, if your home is valued at $300,000 and you owe $200,000, you could potentially get up to $40,000 with an FHA cash-out plan. The Mortgage Reports says you’re not obligated to borrow the entire amount of money, but you would be obligated to pay closing costs, which typically range from 2% to 6% of the loan amount.

The cash can be used for any purpose, but some of the most popular uses include home improvement projects, credit card debt consolidation, college tuition and refinancing from an adjustable-rate loan into a fixed-rate.

There are some drawbacks to refinancing through an FHA cash-out plan. These drawbacks can include paying higher mortgage insurance premiums, increasing your overall debt, and property limitations, as you can only use an FHA cash-out refinance on your primary residence.

To qualify for an FHA cash-out plan, homeowners must meet the following requirements:

- A credit score of at least 600 (with most lenders)

- A debt-to-income ratio below 43%

- More than 20% equity in the home

- On-time mortgage payment history for the past 12 months

The online ads claiming homeowners can get up to $185,000 from the “FaCOP Refi Initiative” do not disclose that homeowners actually have to apply to refinance their mortgage with an FHA-approved lender or meet certain requirements in order to get the cash.

VERIFY found that the clickable links in one of the ads leads to a warning from Google Chrome that reads: “Attackers might be trying to steal your information.”

Another ad links to a website that calls itself an “independent, advertising-supported comparison site” that attempts to get people to answer questions about their mortgages. It is not affiliated with the government.

Similar scams have circulated online in the past few years.

In 2022, scammers claimed homeowners could receive a home equity stimulus of up to $185,000 “to spend on vacations, pay off credit cards, make renovations or retire comfortably.” The claim, which circulated on Facebook, was flagged by independent fact-checkers.

In 2021, scammers claimed homeowners could qualify for a stimulus program that would give them $3,708 every year. We VERIFIED that was false.

The Federal Trade Commission (FTC) and USA.gov both say ads, texts, emails and websites promising “free money” from the government are known as government grant scams. The Better Business Bureau (BBB) shares the following tips on how to spot these scams:

- Free money doesn’t come easy. Obtaining a government grant is an involved process, and one where the grant seeker pursues the funds, not the other way around. If someone is actively soliciting you to give you money, that’s a red flag that you are dealing with an imposter.

- Do not pay any money for a “free” government grant. If you have to pay money to claim a “free” government grant, it is not really free. A real government agency will not ask you to pay an advanced processing fee.

- Check for look-alikes. A caller may say he is from the “Federal Grants Administration,” which does not exist. Be sure to do your research to see if a government agency or organization is legitimate.

- Be careful with unsolicited calls asking for your banking information. Scammers will cold call you, asking basic questions to see if you qualify for a grant. Then they’ll ask for your banking information, claiming they need to collect a one-time processing fee. Avoid sharing your personal information with them, and hang up.

“Real government grants require an application, and they’re always for a very specific purpose,” the FTC says. “You can learn more (for free) at grants.gov.”

If you’ve spotted or fallen victim to a government grant scam, you can report it to the FTC at ReportFraud.ftc.gov or the BBB Scam Tracker.