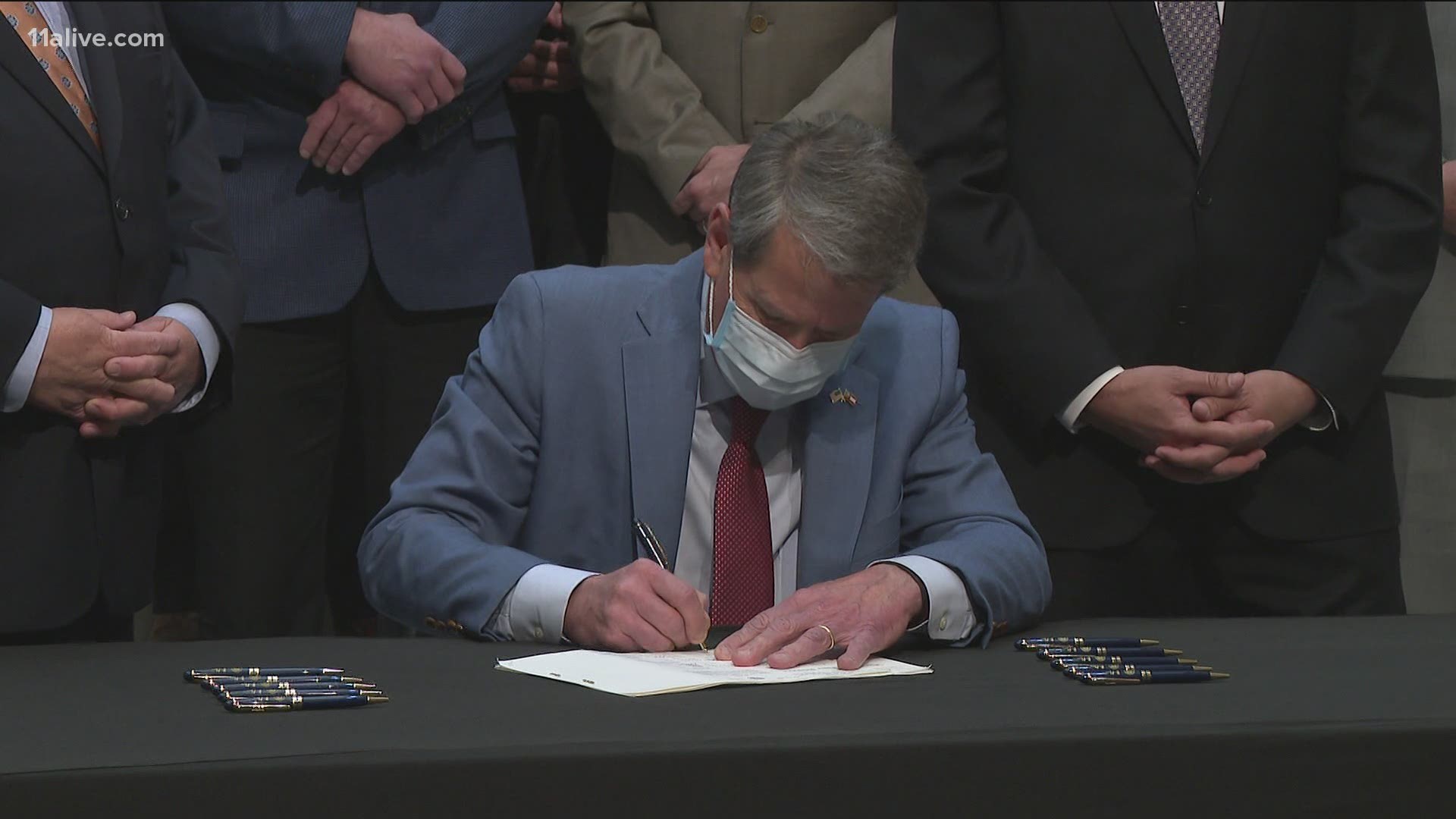

ATLANTA — Georgia Gov. Brian Kemp signed a $140 million state income tax cut into law Monday, raising the standard deduction on state income tax returns.

House Bill 539 specifically raises the state's standard deduction for individual filers by $800 to $5,400 and by couples filing jointly by $1,100 to $7,100.

“The Tax Relief Act of 2021 cuts taxes on Georgians and allows them to keep more of their hard-earned money,” said Rep. Shaw Blackmon (R-Bonaire), Chairman of the Ways & Means Committee. “This measure follows the tax cuts that the House passed in 2018 and 2020 in demonstrating our commitment to keeping the tax burden on Georgians as low as possible.”

The Georgia House unanimously passed the measure without opposition while the Senate passed the bill 35-15.

Experts with the Georgia Budget and Policy Institute questioned the bill's impact for Georgians, citing relief of less than $100. Sen. Sally Harrell (D-Atlanta) also spoke against the bill, urging "a more targeted tax cut for low and middle income Georgians through an Earned Income Tax Credit."

Gov. Kemp also signed HB 114 on Monday, adding incentives for adoptions by increasing adoption-related tax credits. HB 114 has with overwhelming bipartisan support from Georgia lawmakers, passing unanimously in both the Georgia House and Senate.

"Proud to stand with members of the General Assembly to cut taxes for hardworking Georgians and increase incentives for families to adopt children from the foster care system," Kemp tweeted.