JACKSONVILLE, Fla. — The video above was originally published Oct.22, 2020.

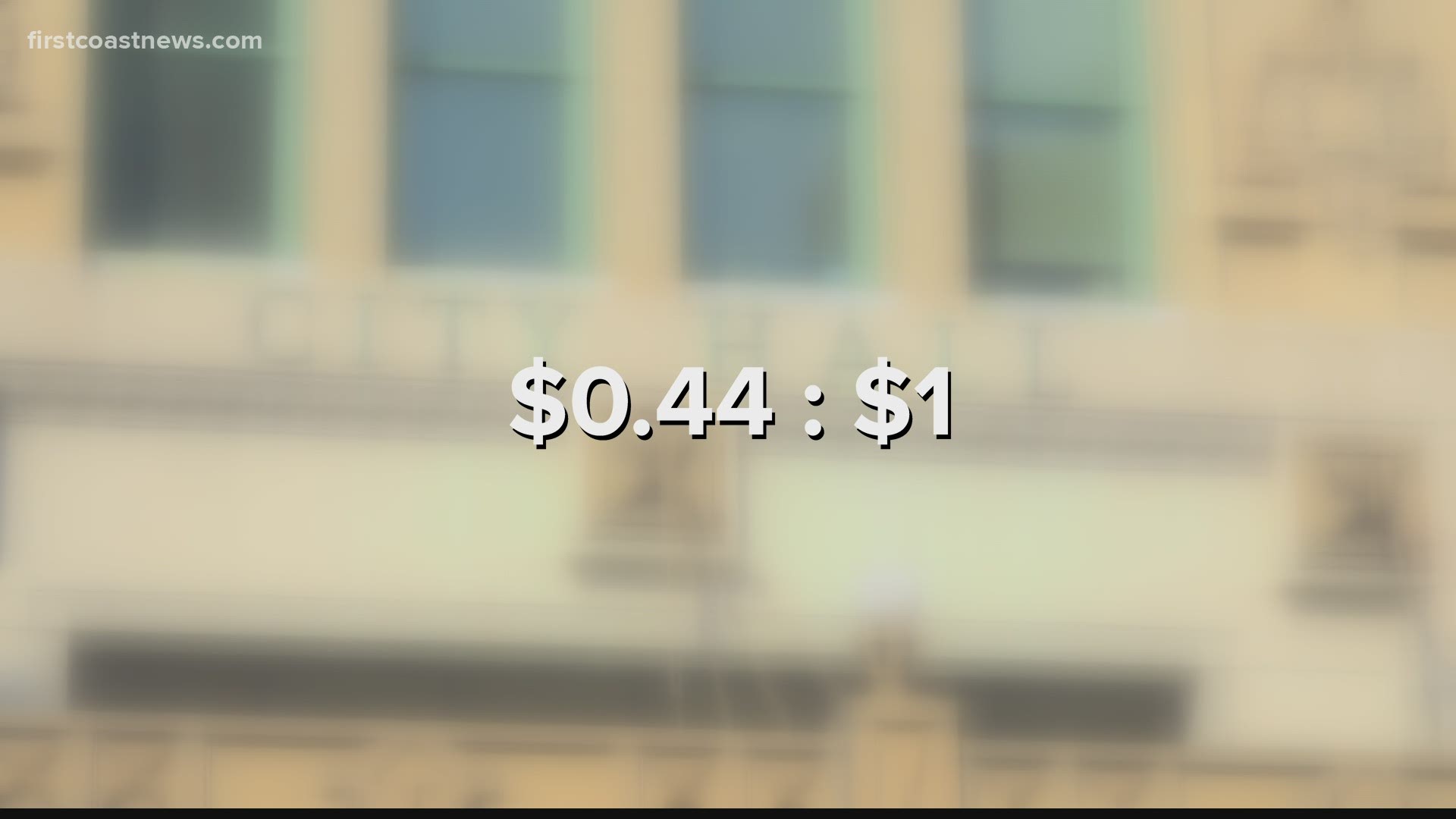

The city's investment of up to $233 million in Jaguars owner Shad Khan's proposed development on Lot J near the football stadium would generate a return for the city of just 44 cents in revenue for each $1 the city puts into the project, according to City Council Auditor Kim Taylor.

Taylor gave her report to City Council during a special meeting Thursday about the Lot J development that saw the proposed deal variously described by council members as a "sweetheart deal" for Khan's development team or as a "once in a lifetime" chance for Jacksonville to propel downtown development.

That return on investment of 44 cents per dollar is far short of the city's typical goal of getting at least $1 in return for each $1 of city incentives for an economic development deal.

The city's Office of Economic Development reached a strikingly different conclusion that said the city would get $1.69 for each $1 it puts into the Lot J project, which would feature an entertainment district, mid-rise residential buildings and a hotel near TIAA Bank Field.

City Council member Randy DeFoor said based on talks she's had with national developers and experts who have done similar projects with NFL franchises, the terms for Lot J are a "sweetheart deal" for Khan and his partner The Cordish Companies.

"It's a fat deal," she said. "Sweetheart deals are great, but we want a married deal, and the only way this project makes any sense at all is if the Jaguars stadium lease is extended for at least 25 years and they commit to a certain number of home games."

City Council member Reggie Gaffney took issue with the questions and comments raised during the meeting about the proposed deal.

"If I was the Cordish group or the Jaguars, I'd probably walk out of here because you've got someone who's willing to invest in your city," he said.

He said the Jaguars made a "great presentation" and the city should be eager to welcome several hundred million dollars of private investment in downtown.

"We're at this point where we can move forward," he said. "I'm not sure if that's what some of us want to do. I would beg you don't miss this opportunity because they don't come but once in a lifetime."

The meeting was the first time the City Council has met together to hear presentations about pending legislation for a proposed deal negotiated by Mayor Lenny Curry with Khan and Cordish Companies for the Lot J development.

Curry spoke to council at the start of the meeting by saying the development is a way to turn rhetoric into reality about the importance of downtown development in achieving Jacksonville's potential.

"We are absolutely at a crossroads for our downtown," Curry said. "Local, national and global development interests are watching the decisions we're about to make. They want to know are we ready to be bold."

"We've had studies, we've had workshops, we've had speeches about our potential," Curry said. "The time for action has arrived."

City Council member Matt Carlucci wants an outside firm to review the viability of the proposed Lot J development.

RCLCO Real Estate Advisors would do the review at a cost of $26,500 that Carlucci said would be money well-spent considering the huge amount of taxpayer dollars at stake.

"I think the council needs as much information as we can on the largest public-private partnership in our history before we make a vote, and I think it should be from an outside party that can give us an independent view," Carlucci said in an interview before the Thursday meeting.

He compared it to the homework he has done in the private business world in deciding on whether he would invest his own money in a business.

"I had everything looked at with a fine-toothed comb," Carlucci said. "I think we owe it to the taxpayers of Jacksonville to do that. We love the Jaguars. We are happy Mr. Khan has made investments in our city and wants to make more investment in our city, but I think we owe it to ourselves to have a good independent review."

The Lot J development has an estimated cost of up to $466 million for building two mid-rise residential building with about 400 units, a hotel with 150 to 250 rooms, a Live! entertainment district with 75,000 square feet of space, and 40,000 square feet of Class A office space.

The cost of the project also covers about 1,400 parking spaces in a new surface lot and in garages built as part of the residential mid-rises. The surface lot would be built by filling in a large drainage pond next to Lot J and covering it with asphalt. The development also would bring streets and utilities to the site while dealing with environmental remediation from the site's industrial past.

The city would borrow as much as $208.8 million to go toward the cost of building the Lot J project.

The borrowing covers $50 million for the city's share of building the entertainment district, a $65.5 million no-interest loan to the private development team, $77.7 million in infrastructure improvements, and a $15.1 million contingency for the city's maximum cost of overruns on infrastructure construction.

On top of that, the deal would rebate up $12.5 million in property taxes for the residential buildings and a $12.5 million cash grant for completing the hotel. The property tax rebate, which also would be paid after the buildings are done, would be 75 percent of the additional city tax revenue generated by the value of the residential buildings for a 20-year period.

Taylor said the council auditor's review used the typical model for calculating return-on-investment based on the city's public investment policy.

The auditor's report said that in return for putting up $233.3 million, the city's multi-year return would total $102.6 million based on future property taxes, sales taxes, hotel bed taxes and an amount deposited in a fund to go toward repaying the city's loan.

The city's Office of Economic Development said the city's financial incentives for the development would be a much smaller amount of $90.5 million and the return would be $152.9 million.

The difference is that on the incentive side, the city administration's calculations did not include $50 million in cash and up to $92.8 million in infrastructure costs that are part of the proposed deal. Taylor said those costs should be included in the calculations because the city would not be spending that money if not for the Lot J development.

On the "returns" side of the ledger, the city administration included the $50 million amount that the private developers will pay toward the Live! entertainment district. Taylor said her office excluded that because the benefit to the city of the Live! district is captured by the tax revenue generated by the project.

The proposed deal says the city will be the owner of the buildings housing the entertainment district. While that would give the city a brick-and-mortar asset, the government ownership means those buildings won't generate any property taxes.

The city would lease the building to the private development team for a 35-year term at $100 a year, with the possibility of four more 10-year lease extensions so the lease could run as long as 75 years.

Councilmember Danny Becton said he agrees with how the council auditor crunched the numbers, saying they "nailed it in terms of their analysis."

Councilmember Aaron Bowman, who is senior vice president of development at JAXUSA Partnership, said the proposed Lot J project is exciting and the terms of the deal are "not out of line. It's in a perfect place for us to work it."

"Let's not start shooting this thing before we've even had a chance to understand it," he said. "We're in a place to make this city great."

While several City Council members have said extending the Jaguars lease at the city-owned stadium should be part of the Lot J development deal, Jaguars President Mark Lamping and city Chief Administrative Officer Brian Hughes said that is a separate issue from Lot J.

The team's lease for the stadium runs through 2030.

Hughes said that to the extent that people have concerns about whether the Jaguars are going to stay in Jacksonville, the private development team's willingness to spend more than $200 million "into what is now a flat asphalt parking lot seems to be the best indicator that there's a long-term, multimillion-dollar plan to stay and make the most out of everything we do down there."

"I know everyone has different points of views on a project this size and they should, pro and con," Lamping said. "But please judge us on our actions to date, including our discussion of what we're dong today."

"What we're doing is designed to get us to a place where we can ensure NFL football in Jacksonville for generations to come," Lamping said.

Next up for the council will be an expected vote Tuesday on Carlucci's legislation to hire RCLCO Real Estate Advisors to do a review of the development deal.

Council will have a public hearing during the Tuesday meeting on the Lot J legislation and then is scheduled to meet again on Nov. 19 in a special meeting about Lot J.

The proposed development agreement still will go through several more weeks of review by council members, but Carlucci's proposal for having an independent review could come up at next Tuesday's meeting of the council.

Click here to read this article from the Florida Times-Union.