A local watchdog group created to improve transparency in city government is urging City Council members to take more time to determine whether giving up to $233.3 million in public incentives toward the proposed Lot J development is the best deal for taxpayers.

OurJax, which was formed last year by residents angered by the controversial attempt to sell JEA, sent a letter to all 19 council members last week that identified its concerns about Mayor Lenny Curry’s proposed deal with Jaguars owner Shad Khan to build the mixed-use development next to TIAA Bank Stadium — as well as the results of a recent poll that found 70 percent of respondents were opposed to the city’s proposed investment in the project.

“Jacksonville continues to reel from the scandal to sell JEA. The rushed Lot J transaction appears to OurJax eerily similar to the faulted secretive process that surrounded that debacle,” according to the letter, which was signed by Michael Ward, a former chief executive officer of CSX and board member of OurJax. “After the fallout and public reaction to the JEA issue, we wanted to believe that our elected officials had learned an important lesson. We were wrong.”

The council has already held the first of at least two special meetings to review the deal. While the council was prepared to vote on the deal as early as the next special meeting on Nov. 19, it’s unclear whether the cancellation of Tuesday’s council meeting, which happened after a council member tested positive for the coronavirus, will impact that timeline.

Curry has proposed giving Khan and his development partner, the Cordish Companies, a cash-rich incentives package to build a "live-work-play" development that would be anchored by an outdoor entertainment district made up of bars, restaurants and retail. The development would also feature 400 residential units, a hotel and 40,000-square feet of Class A office space.

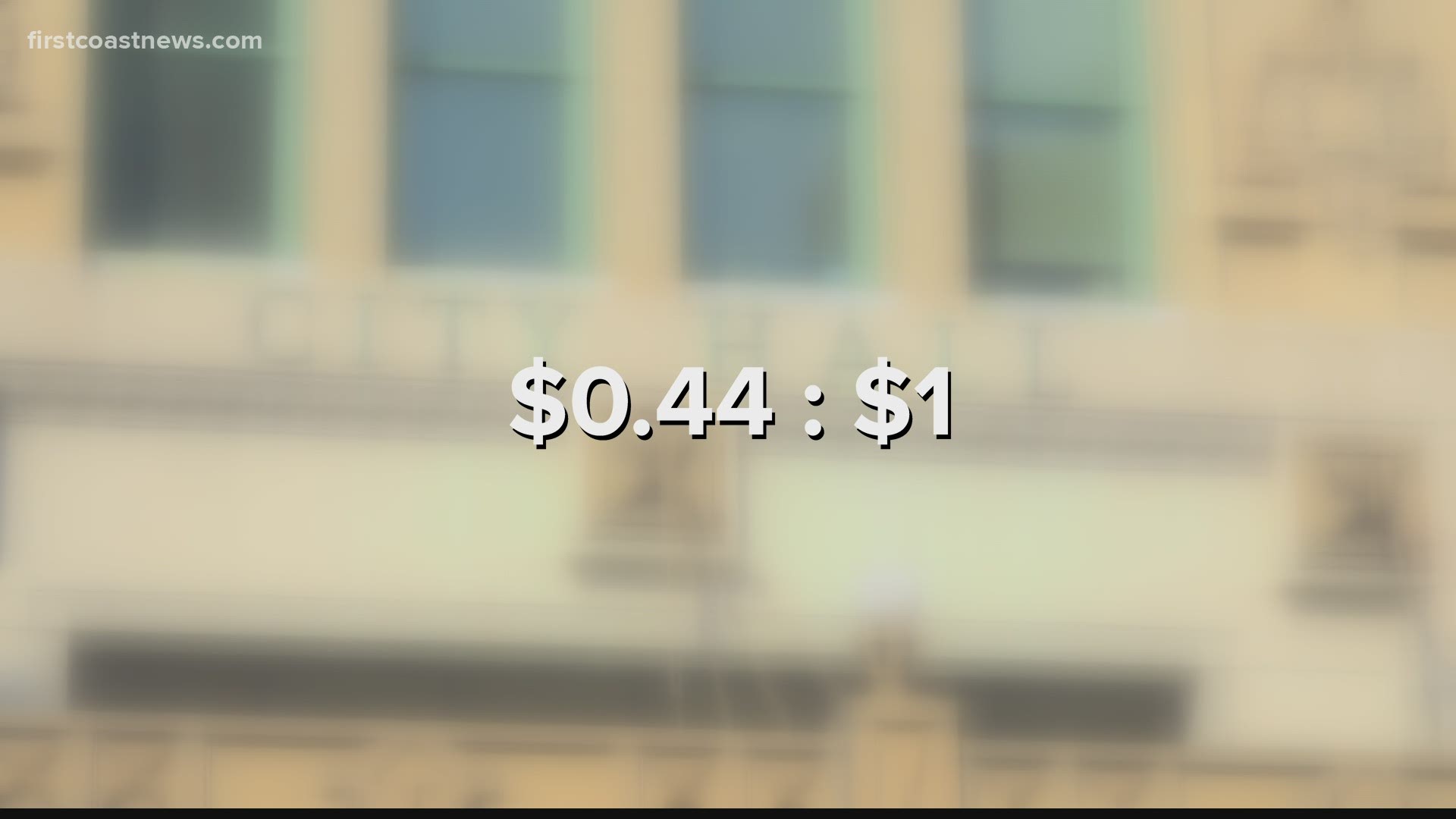

City Council Auditor Kim Taylor said during last week’s special meeting that the city’s investment would generate just 44 cents for every dollar spent, a figure well short of the dollar-for-dollar benchmark the city typically strives to reach when subsidizes private development.

The City’s Office of Economic Development, which is led by a Curry appointee, has provided a more optimistic outlook on the project, which it says would generate $1.69 for every dollar the city invests.

Some council members have said the deal, which is the most lucrative the city has ever given to a single project, is too favorable towards Khan and would be easier to justify if Khan extended his lease of the city-owned stadium, which expires in 2030.

In their letter, OurJax urged council members to “not rush” their evaluation of the deal and listed a number of concerns, like the low return on investment and lack of information about the project.

Audrey Moran, an attorney and board member of OurJax, said the organization is "proud" that Jacksonville is an NFL city and isn't opposed to Khan's vision for Lot J. However, she said the organization was formed to promote integrity, transparency and accountability and that it “appears those pillars are under attack.”

“What is the rush? Let's do our homework, and let's make this the very best deal we can make it,” said Audrey Moran, an attorney and board member of OurJax. “There could definitely be a Lot J deal that is in the best interests of the citizens of Jacksonville, but we're not there yet.”

The Lot J development has an estimated cost of up to $466 million for the development. The city would borrow as much as $208.8 million to go toward the cost of building the Lot J project.

The borrowing covers $50 million for the city's share of building the entertainment district, a $65.5 million no-interest loan to the private development team, $77.7 million in infrastructure improvements, and a $15.1 million contingency for the city's maximum cost of overruns on infrastructure construction.