ST. LOUIS — An extra $1,200 in the bank was a welcome surprise for many Americans over the weekend who weren't expecting stimulus checks until this week.

The first payments were deposited several days ahead of schedule on Friday night. By Wednesday, April 15, tens of millions of Americans will have received their checks.

The people getting theirs first are the ones who filed tax returns in 2018 or 2019 and received funds through direct deposit.

People who didn’t file taxes, are very low income or are older and don't need to file will have to wait for their money. Any paper checks should go out starting early May.

Elise Gould, a senior economist with the Economic Policy Institute, said some might not see the money until mid-summer.

“There’s going to have to be a way to collect their information, and that process could take a couple months,” Gould said.

The IRS is creating a web portal where users can check the status of their stimulus payments. The site will also have a feature to enter bank account information if the IRS doesn’t already have it from a 2018 or 2019 refund. The IRS expects this to launch by Friday, April 17.

These stimulus checks are part of the $2.2 trillion dollar stimulus plan announced last month. People who make $75,000 or less will receive the full $1,200 check. That amount will phase out, capping at people making $99,000. Households will receive an additional $500 for children under 16 years old.

“These checks are a good start, they’re very important for families,” Gould said. “It means the difference between paying rent and putting food on the table.”

However, Gould warns a one-time check isn't enough to get a family through the pandemic.

“Some of the money is due to end, and end prematurely. We need to keep that relief money going through the pandemic and consider it as stimulus when we get on the other side so it can get demand up and get all these people back to producing goods and services,” she said.

Part of the CARES act will give unemployed workers $600 a week, which will provide additional relief.

Who is getting the money first

The people getting theirs first are the ones who filed tax returns in 2018 or 2019 and received funds through direct deposit. People who didn’t file taxes, are very low income or are older and don't need to file will have to wait for their money. Any paper checks should go out starting early May.

Elise Gould, a senior economist with the Economic Policy Institute, said some might not see the money until mid-summer.

“There’s going to have to be a way to collect their information, and that process could take a couple months,” Gould said.

What if the IRS doesn't have my current bank info for direct deposit?

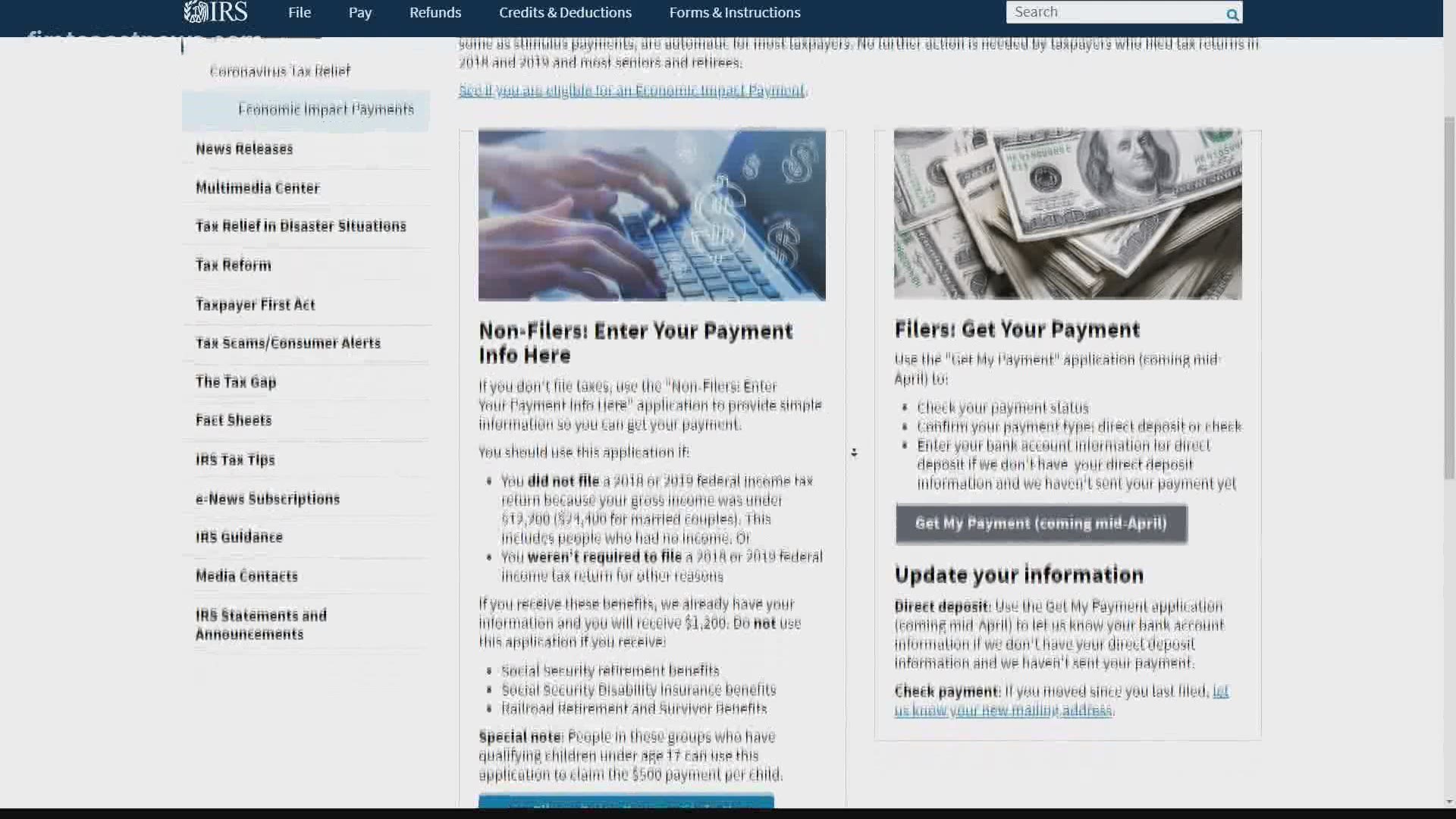

The IRS is creating a web portal where users can check the status of their stimulus payments. It will launch this week. The site will also have a feature to enter your bank account information if the IRS doesn’t already have it from a 2018 or 2019 refund. The IRS expects this to launch this tool by Friday, April 17.

Check this page to view the stimulus check tracker info and look for the "Get My Payment" button, when it launches.

Stimulus check tracker

The coming IRS web portal will also let users check the status of their stimulus payments. The IRS expects this to launch by Friday, April 17.

Check this page to view the stimulus check tracker info and look for the "Get My Payment" button, when it launches.

What if I don't file taxes every year?

The IRS launched this webpage to allow non-tax filers to provide the federal government with payment information. Look for the "Non-filers: Enter payment info here" button.

More Frequently Asked Questions and info from IRS.gov:

Here is what you need to know about your Economic Impact Payment. For most taxpayers, payments are automatic, and no further action is needed. This includes taxpayers who filed tax returns in 2018 and 2019 and most seniors and retirees.

Who is eligible?

U.S. residents will receive the Economic Impact Payment of $1,200 for individual or head of household filers, and $2,400 for married filing jointly if they are not a dependent of another taxpayer and have a work eligible Social Security number with adjusted gross income up to:

$75,000 for individuals

$112,500 for head of household filers and

$150,000 for married couples filing joint returns

Taxpayers will receive a reduced payment if their AGI is between:

$75,000 and $99,000 if their filing status was single or married filing separately

112,500 and $136,500 for head of household

$150,000 and $198,000 if their filing status was married filing jointly

The amount of the reduced payment will be based upon the taxpayers specific adjusted gross income.

Eligible retirees and recipients of Social Security, Railroad Retirement, disability or veterans' benefits as well as taxpayers who do not make enough money to normally have to file a tax return will receive a payment. This also includes those who have no income, as well as those whose income comes entirely from certain benefit programs, such as Supplemental Security Income benefits.

Retirees who receive either Social Security retirement or Railroad Retirement benefits will also receive payments automatically.

Who is not eligible?

Although some filers, such as high-income filers, will not qualify for an Economic Impact Payment, most will.

Taxpayers likely won't qualify for an Economic Impact Payment if any of the following apply:

Your adjusted gross income is greater than

$99,000 if your filing status was single or married filing separately

$136,500 for head of household

$198,000 if your filing status was married filing jointly

You can be claimed as a dependent on someone else’s return. For example, this would include a child, student or older dependent who can be claimed on a parent’s return.

You do not have a valid Social Security number.

You are a nonresident alien.

You filed Form 1040-NR or Form 1040NR-EZ, Form 1040-PR or Form 1040-SS for 2019.

How much is it worth?

Eligible individuals with adjusted gross income up to $75,000 for single filers, $112,500 for head of household filers and $150,000 for married filing jointly are eligible for the full $1,200 for individuals and $2,400 married filing jointly. In addition, they are eligible for an additional $500 per qualifying child.

For filers with income above those amounts, the payment amount is reduced by $5 for each $100 above the $75,000/$112,500/$150,000 thresholds. Single filers with income exceeding $99,000, $136,500 for head of household filers and $198,000 for joint filers with no children are not eligible and will not receive payments.

Do I need to take action?

People who filed a tax return for 2019 or 2018

No additional action is needed by taxpayers who:

have already filed their tax returns this year for 2019. The IRS will use this information to calculate the payment amount.

haven’t filed yet for 2019 but filed a 2018 federal tax return. For these taxpayers the IRS will use their information from 2018 tax filings to make the Economic Impact Payment calculations.

People who aren't typically required to file a tax return

Social Security and Railroad Retirement recipients who are not typically required to file a tax return need to take no action. The IRS will use the information on the Form SSA-1099 and Form RRB-1099 to generate Economic Impact Payments of $1,200 to these individuals even if they did not file tax returns in 2018 or 2019. Recipients will receive these payments as a direct deposit or by paper check, just as they would normally receive their benefits. Social Security Disability Insurance (SSDI) recipients are also part of this group who don't need to take action.

For Social Security, Railroad retirees and SSDI who have qualifying children, they can take an additional step to receive $500 per qualifying child.

There are other individuals such as low-income workers and certain veterans and individuals with disabilities who aren’t required to file a tax return, but they are still eligible for the Economic Impact Payments. Taxpayers can check the IRS.gov tool - Do I Need to File a Tax Return? - to see if they have a filing requirement.

The IRS will soon provide guidance for these individuals on the steps to take to get their payment as soon as possible.

Payment recipients: watch for an IRS letter

For security reasons, the IRS plans to mail a letter about the economic impact payment to the taxpayer’s last known address within 15 days after the payment is paid. The letter will provide information on how the payment was made and how to report any failure to receive the payment. If a taxpayer is unsure they’re receiving a legitimate letter, the IRS urges taxpayers to visit IRS.gov first to protect against scam artists.

More coronavirus coverage: