JACKSONVILLE, Fla. — Withered sheet rock, warped wood, and crusty mold is what a small hole in a pipe can do to your home.

"Carpet was completely soaked it was to the point where even if you stepped on it and made a footprint you could here the water gushing around just like if you walking on the beach," DeVela Cargin said about her home.

A Long Insurance Battle

In February 2021 a small pipe burst in DeVela Cargin's home, flooding it with water. Cargin's son and daughter were living with her at the time. The three had to move to Virginia due to damage from the flood.

Cargin hired Frank Evans, a public adjuster, in the spring to help with her insurance claim. A public adjuster is an insurance professional who helps the policyholder settle a claim with the insurance company.

The two reached out to First Coast News' Ken Amaro in November after a month's long battle with her insurance had stalled.

A few days after our story aired, Cargin's claim was settled. After replacing the copper pipes with PVC pipes in her house and getting rid of the mold, she's a few weeks from moving back in.

"I am absolutely ecstatic just to know that there is actually progress now like you can actually see the end of the road," Cargin said.

Breakdown of Water Coverage

For some homeowners, there is no end of the road when it comes to water coverage, more like a brick wall.

"This is kind of what like DeVela had, she had a good policy." Evans said.

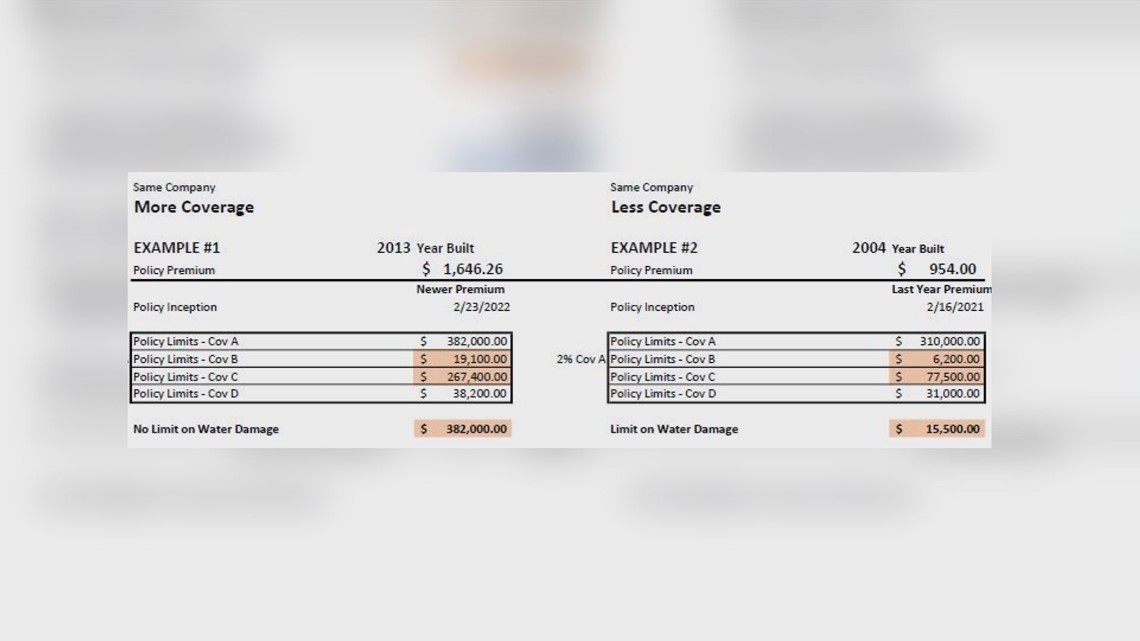

Evans provided First Coast News with two homeowners insurance plans from the same insurance company. We'll call them Policy A and Policy B.

Policy A's premium is $1,646.26, while Policy B's premium is cheaper at $954.

Both policy's outline what they cover as well, we'll focus on 'Coverage A', which is the dwelling of the house.

Policy A has a $382,000 policy limit for the dwelling of the house and has no limit on water damage. So you will be covered for water damage up to $382,000.

Policy B has a $310,000 policy limit for the dwelling of the house, but has a limit on water damage at $15,500. So you will only be able to claim up to $15,500 in damage, even if your insurance estimate exceeds your limit.

Cargin had a policy similar to Policy A. For example, Evans estimated her damage at $120,000 and she was able to negotiate with her insurance company to get necessary insurance money because she did not have a low limit on water damage coverage.

"When you have a substantial claim like this you don't save up for that you kind of expect your insurance carrier to have that," Evans said.

The Troubling Trend

Evans and Florida Association of Public Insurance Adjusters, Chris Cury, say they have seen diminishing water damage coverage for the last decade or so, and it's a real problem.

"These could result in foreclosures, these could result in financial catastrophes for families," Florida Association of Public Insurance Adjusters, Chris Cury, said.

Cury added there are two different types of insurance carriers, admitted carriers and surplus lines carriers.

Admitted carriers need to go through the Office of Insurance Regulation for any changes in their policies.

"They're getting approved by the Office of Insurance Regulation, unfortunately the state is allowing this to occur and that's a problem for sure," Cury said.

Surplus lines carriers can make changes at will without going through the OIR, Cury said to avoid these companies.

"You really need to be aware whether or not you have an admitted carrier or a surplus lines company because those surplus lines companies, while necessary and valuable, they could have all kinds of outrageously limiting terms in their policy that was not approved by the OIR," Cury said.

Cury said FAPIA has worked with the department of financial services and state legislature to propose solutions to some issues.

He did say that is has been difficult given FAPIA's small footprint and that the consumer has the most power.

"Until consumers standup and voice their concerns they're going to have to be the frontline of their individual respective policies and properties. The regulators don't hear the consumers complaining about what's going on out here," Cury said.

Cury's biggest piece of advice for consumers is to read their policy's and ask for help from a public adjuster, so you can restart, instead of starting over.

"If you've ever looked at your insurance policy it's pages and pages and pages of a lot of things, and you're like ok what am I exactly covered for and then you find out that what you're covered for you're really not," Cargin said.