JACKSONVILLE, Fla — Hurricane season has arrived, and we want to make sure you know enough about the storms to make informed decisions on how you prepare.

The claim:

FALSE—A higher category storm is more damaging than categories below them

Sources

- The National Weather Service

- First Coast News Meteorologist Lauren Rautenkranz

- Legal Experts with Anidjar and Levine

First, let’s define a hurricane.

A hurricane is a storm with winds above 74 miles per hour.

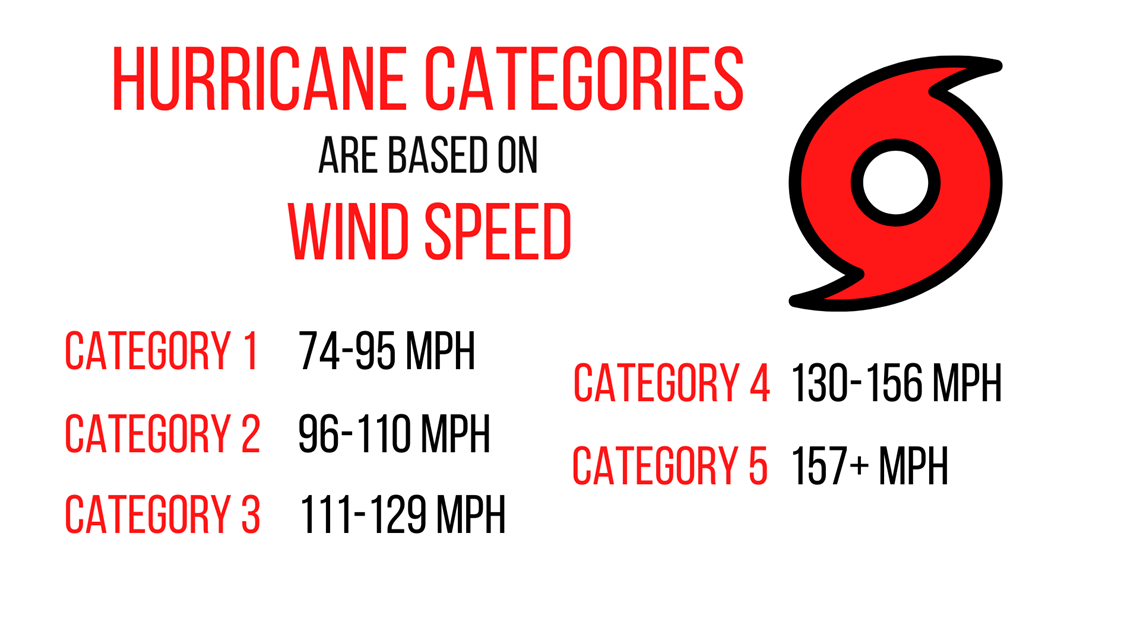

Hurricane categories are also determined by maximum sustained wind speeds.

According to the National Weather Service, these are wind speeds that define each hurricane category.

We know that higher winds can bring more damage, but First Coast News Meteorologist Lauren Rautenkranz said there’s another damaging factor that is not taken into account when determining hurricane categories, and that’s flooding.

“You can have a category one storm that sits and dumps 12 inches of rain on you, and you can have a category five that blows on through and dumps three inches of rain,” Rautenkranz said.

Although winds bring damage, hurricane categories do not consider rain and storm surge, which is determined to be the deadliest impact storms can have.

For that reason, we are verifying the claim that “higher category hurricanes are more damaging than categories below them” as false.

Every major storm should be taken seriously, no matter what category it is.

Homeowners insurance is crucial in Florida, but are there only certain times you can get it?

The claim:

TRUE—Sometimes, you can’t buy homeowners insurance during hurricane season in Florida

Hurricane season in Florida begins June 1st and ends November 30th.

You can usually buy insurance in that time frame, but not always.

Nick Basco, an associate attorney at Anidjar and Levine said many companies freeze opening new policies or upgrading current policies if a storm is on the horizon.

“When they issue a policy, they’re hoping that you’re not going to have a claim,” Basco said. “So the fact that a hurricane or a tropical storm could be coming increases that shot.”

Basco said companies may freeze issuing new policies if there is any storm watch or a warning within the state of Florida or depending on the geographic area the storm is located.

For those reasons, we verify the claim that “sometimes you can’t buy homeowner’s insurance during hurricane season in Florida” as true.

Another important thing to be aware of is “When you apply for insurance, usually there is a 24 to 48 hour waiting period before that policy becomes effective,” Basco said.

There is not one uniform rule. Different insurance companies have different criteria, which is why you need to consult your insurance company to know where you stand.