JACKSONVILLE, Fla — Some unemployed Floridians who didn’t have taxes deducted from their unemployment benefits may have a hefty payment to the government in the coming months.

“A lot of people did not elect to have taxes taken out because it was so little,” said DirecTax manager Jessica Ortega. “Which can affect them when they file their taxes.”

Each installment of benefits may not seem like much, but after accumulating for weeks, those payments add up to an amount some struggling Floridians can’t afford.

If taxes haven’t been taken from your payments, Ortega suggests setting aside 10 percent of the total amount of unemployment benefits received.

Ortega said if you don’t have the money, still make sure you file.

“Go ahead and file your taxes so you don’t get a late penalty charge and they can do payment arrangements with IRS,” Ortega said.

Unemployed Floridians should receive a 1099G tax document from the Florida Department Of Economic Opportunity by the end of the month.

“What they’re going to receive in the mail, or they’re going to have to print it is a 1099-G,” Ortega said. “Which tells you how much money they received for the year in unemployment.”

That document will need to be filed along with any other tax documents accumulated in 2020.

“They cannot leave it out because IRS will send a letter later on explaining they owe more money and they’ll have interest and penalties added onto that, and they don’t want that to happen,” Ortega said.

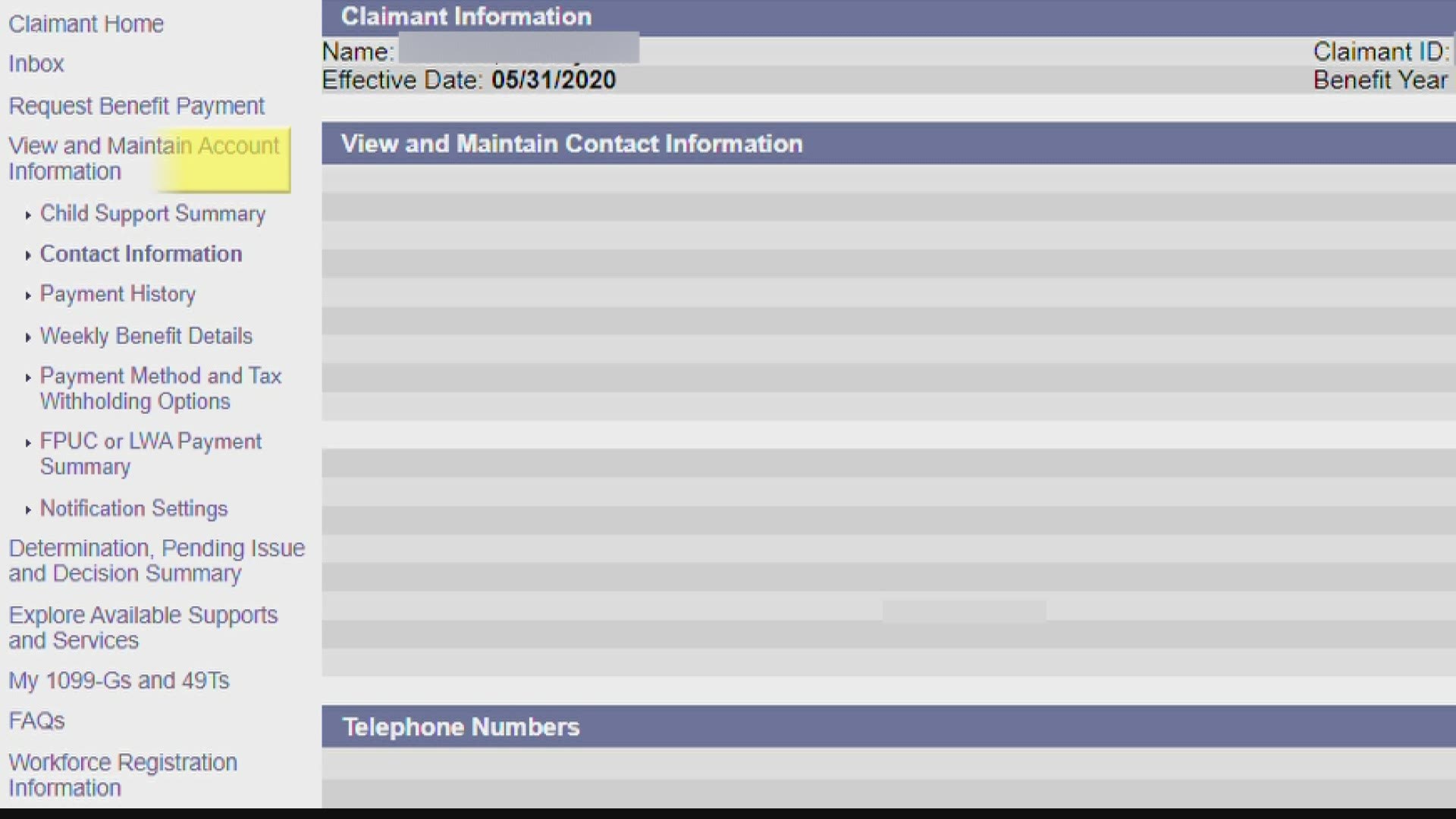

You can find how you’ll receive your document by pressing “view and maintain account information” in your CONNECT account. Under “contact information,” it will show whether your correspondence preference is electronic or mail.

Some claimants say their 1099G is inaccurate. If you are having trouble, fill out the form at https://www.1099grequest.myflorida.com/.

Here's a link to DEO's 1099G Guide.